The Only Guide for Opening An Offshore Bank Account

Table of ContentsExamine This Report about Opening An Offshore Bank AccountOpening An Offshore Bank Account - The FactsThe Definitive Guide for Opening An Offshore Bank AccountUnknown Facts About Opening An Offshore Bank AccountThe Only Guide to Opening An Offshore Bank AccountThe Best Strategy To Use For Opening An Offshore Bank Account

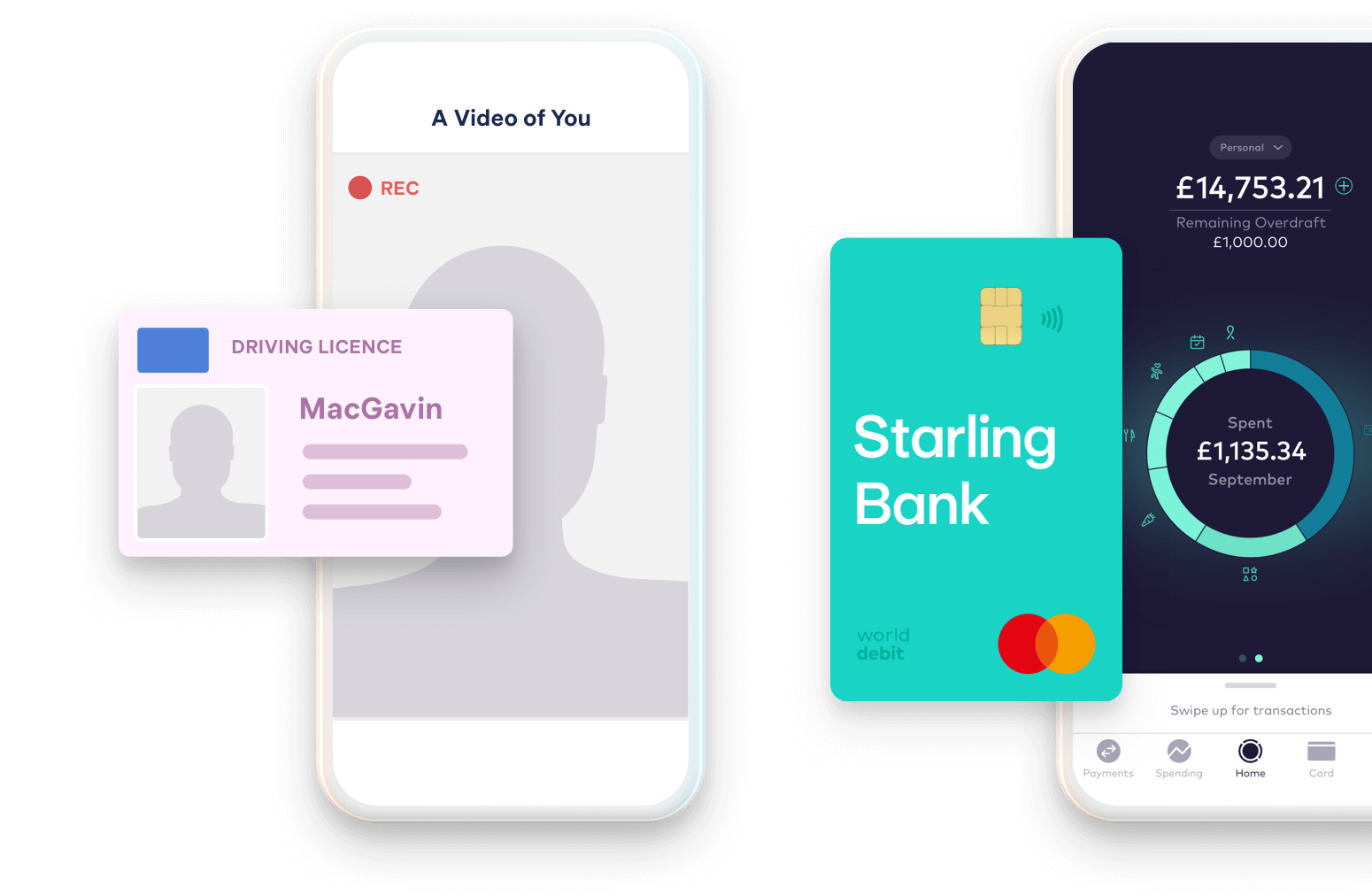

Whether you're assuming of transferring to the UK or you have actually shown up there already, eventually you're going to need a financial institution account. In the past, opening up a financial institution account in the UK was extremely tough if you were brand-new to the country. The good news is, these days, it's ended up being slightly less complicated (opening an offshore bank account).Once you have actually changed your address, ask your bank to send out a financial institution statement to your brand-new address by article, and you'll have a record that proves your UK address. If you don't have an evidence of address in the UK and you need to open up an account, Wise's multi-currency account might be the right option for you.

Can I open up a checking account before I arrive in the UK? Yes, you can. Your house financial institution might be able to establish a make up you if it has a correspondent banking partnership with a British bank - opening an offshore bank account. Many significant UK financial institutions additionally have so-called. These are developed particularly for non-residents, so they're a terrific alternative if you do not have the documents to prove your UK address.

Not known Details About Opening An Offshore Bank Account

You may not be able to close the account and also switch to a better bargain till a set period of time ends. The Wise multi-currency account.

Some banks are strict with their demands, so opening a bank account with them will certainly be challenging. What is the easiest checking account to open in the UK? It's usually simpler to open up an account with among the - Barclays, Lloyds, HSBC or Nat, West. These banks have stayed in business for a long time and also are extremely secure.

The 7-Second Trick For Opening An Offshore Bank Account

Nevertheless, the are Barclays, Lloyds, HSBC and Nat, West. Allow's have an appearance at what each of them have to use. Barclays Barclays is among the earliest financial institutions in the UK; and has greater than 1500 branches around the nation. It's also most likely one of the easiest financial institutions to open up an account with if you're brand-new to the UK.

The account is complimentary and comes with a contactless visa debit card as requirement. However, you won't have the ability to use your account immediately. When you remain in the UK, you'll need to see a branch with your recommendation number, ticket and also proof of address in order to activate the account.

Barclays also offers a couple of various service accounts, depending on the annual turn over rate. You can contact customer assistance through a live chat, where you can review the information of your application as well as ask inquiries in genuine time. Lloyds Lloyds is the largest service provider of bank accounts in the UK, and has around 1100 branches throughout the nation.

Opening An Offshore Bank Account Fundamentals Explained

You can contact customer support via a live conversation, where you can review the details of your application and also ask any inquiries in actual time. Other banks worth looking into While Barclays, Lloyds, HSBC and Nat, West are the four largest financial institutions in the UK, there are additionally various other financial institutions you can check.

Of course, it's always best to look at what different banks have to supply and see that has the ideal deal. You can obtain a basic present account at no monthly cost from resource most high street banks.

A lot of financial institutions also have premium accounts that provide extra benefits such as cashback on family costs, in-credit interest and insurance. These accounts will certainly usually have monthly costs and also minimal qualification demands; as well as you might not certify if you're brand-new to the UK. You'll also require to be mindful to remain in credit history.

Opening An Offshore Bank Account for Beginners

If you're not making use of one of your bank's ATMs, inspect the equipment. Many banks will bill a, which can be as high as 2.

When you open this account, you'll have the alternative to take out an. A set up overdraft account permits you to obtain money (up to an agreed restriction) if there's no money left in your account. This can be valuable if you're struck with an unexpected expense. If a settlement would take you previous your prepared limit (or if you do not have one), we may let you borrow utilizing an.

An Unbiased View of Opening An Offshore Bank Account

We'll always try to permit important settlements if we can - opening an offshore bank account. You can look for a set up overdraft account when you open your account, or at any moment later. You can ask to visit our website increase, remove or decrease your limitation at any time in online or mobile banking, by phone or in-branch.

We report account activity, including over-limit usage, to credit history recommendation firms. An unarranged overdraft lasting more than thirty day could have an unfavorable influence on your credit report ranking. This account comes with a. If you go overdrawn by even browse around this web-site more than that, you'll need to pay passion on the quantity you obtain at the rate shown.